Welcome to Rebel Markets Newsletter by Gannon Breslin. If you haven’t subscribed, please join to learn more about investing, business, personal finance, tech, and all things that involve money alongside 5,451+ other subscribers.

Hello friends,

It's been a while but you know I can't help myself chime in whenever sh*t hits the fan. Over this past weekend, the largest bank failure since 2008 and the second largest bank failure in U.S. history occurred in a mere 48 hours sending the internet and finance community into a frenzy we haven't since that scumbag SBF stole everyone's money. (he is still not in jail btw)

Before we head into this article, I want to state that in no shape way or form am I celebrating the failure of Silicon Valley Bank. This is a tragedy that is going to affect tens of thousands of lives, crush possibly hundreds of startups, and have a ripple effect we can't even calculate. I will however be using comedic relief to point out the ridiculousness of it all and how bankers are thick as thieves.

In this article I will be covering:

What happened to SVB

Who is at fault, how do bonds work

Was SVB actually reckless?

SVB CEO in hot water after stock sale

Jason and David Sacks drama

How to turn crisis into opportunity

Read time: It's worth it

Silicon Valley Bank 🏦

For those unaware, Silicon Valley Bank, or what we will refer to as SVB was "THE startup bank" meaning that since its inception in 1983, it has been home to banking services for countless tech startups and provided financing for almost half of US venture-backed technology and healthcare companies. This wasn't a "mom-and-pop" bank either: SVB is among the top 20 American commercial banks that held up to $209 billion in total assets as of the end of last year, according to the FDIC (if you don't know what the FDIC is you will be learning all about it very soon).

Why Did SVB Fail?

The TL, DR is this was a classic bank run (meaning clients rushed to request their money all at once) and the bank did not have the funds on hand. However, no epic bank failure of this size happens because of one reason, this was a cascade of events that transpired over a year or so.

The Larger Economy 📉

If you have been living under a rock the Fed has continued to raise rates in an attempt to fight rampant inflation. The stock market and in particular tech stocks have gotten hit hard - as stated before, almost all of SVB's customers are tech companies so this economic + market climate has been extremely bad for business.

Bond Prices Go Bust 📉

The oily rag found after the fire, SVB did what banks do best (invest your money recklessly the second you put money into the bank). Way back when there were ultra-low / practically zero interest rates SVB bought a boatload of long-term Mortgage Backed Securities MBS (lol remember the Big Short?). Well as interest rates hiked SVB started to lose their ass off on these bonds. To put it in perspective, on Friday the 4.57% bonds due April 2033 traded as low as 31 cents on Friday (that's incredibly bad considering anything trading below 70 cents is considered distressed)! When clients rushed to yank their funds out of the bank SVB was forced to sell these bonds for a tremendous loss - around $1.8 BILLION in losses.

💡 Learning Moment: Some of you might be wondering why bond prices fall when interest rates go up. Think about it, let's say Jimmy is offering a fixed-rate bond at 3%. When interest rates rise there are more attractive bonds on the market at let's say 6%. Who in their right mind would choose to receive 3% when they could go with the new 6% bonds? The only way the 3% bond can compete and stay attractive in the bond market is the price of the bond (not the interest rate) needs to go on discount for buyers. This is exactly what happened to SVB's bonds they purchased. The bonds substantially dropped in price and they were forced to sell to cover the clients who were pulling their money out of the bank.

Was SVB actually Reckless?

This is of course an opinion but I fail to find any avenue that suggests it wasn't. SVB had to sell its $21 billion bond portfolio which was only yielding an average of 1.79%. This is what we describe as the complete opposite of an asymmetric bet - meaning that the payoff for buying these bonds was extremely minimal. To throw salt in the wound the 10-Year Treasury yield is around 3.9%. Imagine taking a sports bet in which you put $100 down to only win $1.79 but have the chance of losing everything if the bet goes wrong. In all the bonds that were purchased weren't wreckless it was the amount and timing in which the bonds were purchased.

Now I know some people are going to say "well SVB didn't know interest rates were going to hike when they bought the bonds, and the rate was at 0% at the time so it actually wasn't a bad bet all things considered" or "if they didn't have to sell the bonds they would've been fine".

My answer to that is: Was the entire risk management team asleep at the wheel? The entire point of a risk management team at a bank is to be always in a position where if sh*t hits the fan you will make it out alive. SVB had too much money wrapped up in these bonds and when the prices started to plummet they didn't want to cut their losses. Were the bonds "bad" bonds? No, but considering the economic environment we were in when the bonds were bought how could you not think that interest rates would rise? (they were literally at zero so they only had one direction to go). Like most bank failures, SVB got greedy and then got caught with their pants down when customers wanted their funds out of the bank. When the bank showed signs of panic so did its clients and it caused a snowball effect of people pulling their funds out. Maybe A.I. solves this (lol too soon)?

I could write an entire article covering the actual banking practices SVB deployed with clients that showed recklessness but this thread below perfectly sums it up.

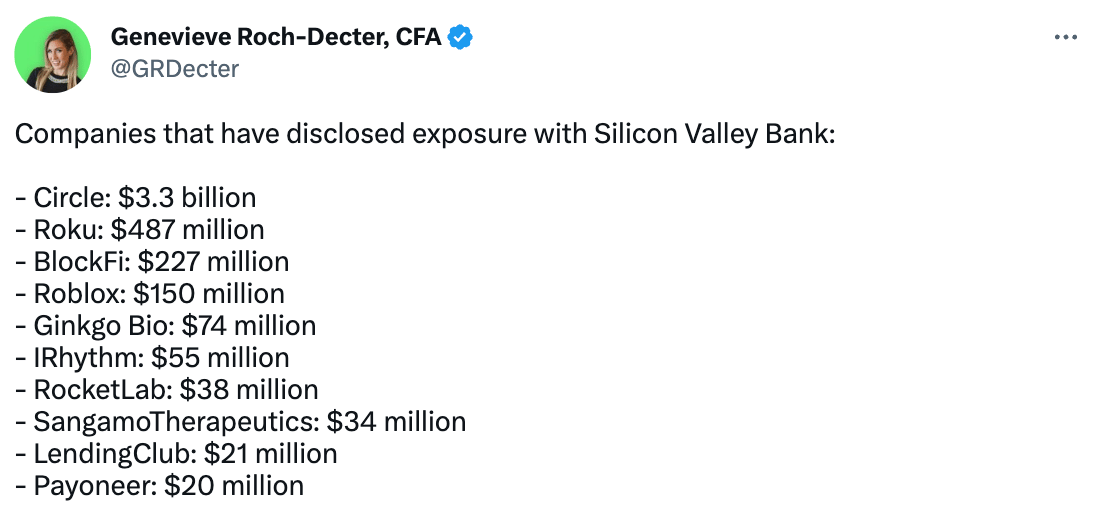

The Damage 🪦

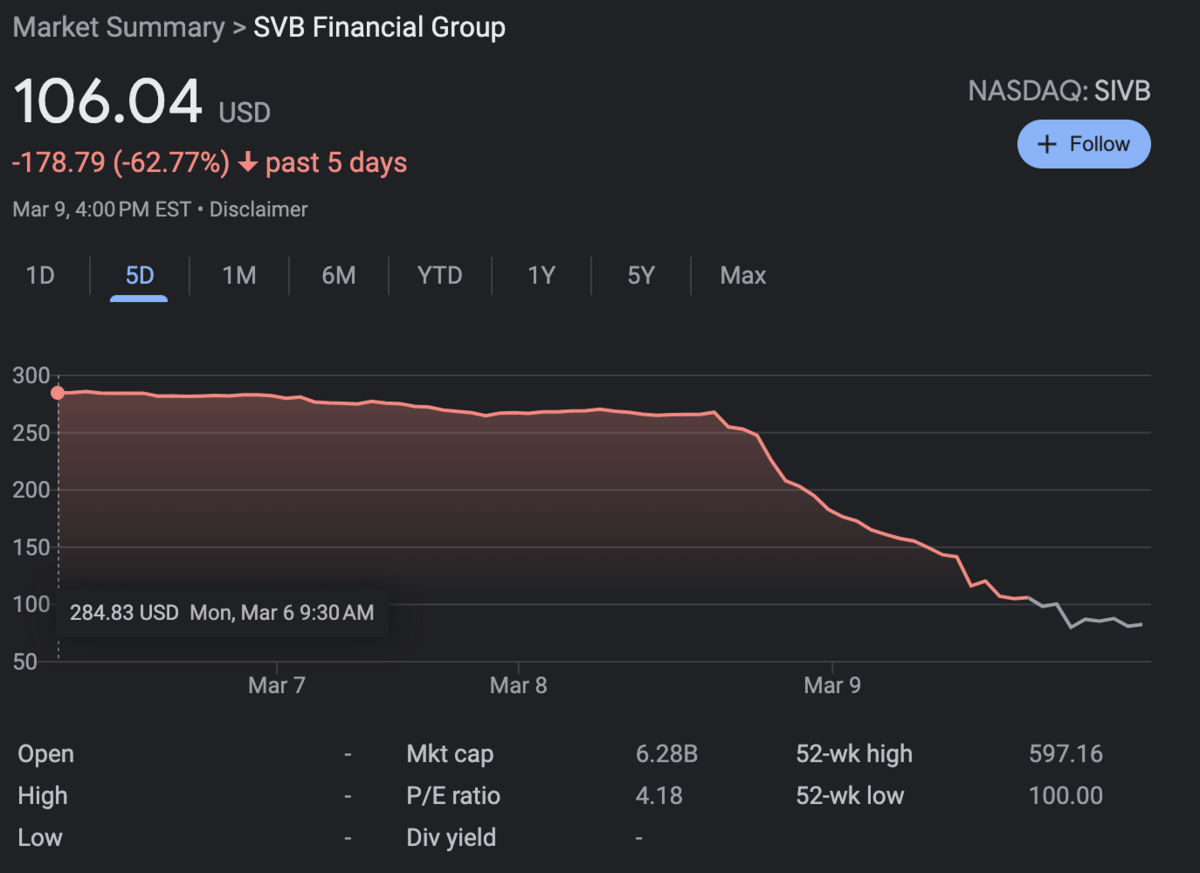

Although a lot of things have happened in the past 10 days for a hot minute thousands of startups don't have access to their funds. On top of this, the FDIC only insures up to $250,000 to depositors. SVB tried to sell $2.25 billion in stock to fill its funding issue but shares started to crash 60% in a blink of an eye. When SVB started to spiral, and the stock sale failed, regulators stepped in to take over. Below is a photo of the share price (keep in mind this isn't accurate since the stock was halted).

💡 Learning Moment: What is the FDIC? The Federal Deposit Insurance Corporation is a United States government corporation supplying deposit insurance to depositors in American commercial banks and savings banks. Long story short its a law to protect some of a client's money when there is a bank failure.

What Happens Now?

I'm glad you got this far. I started writing this newsletter last Monday but the saga kept going so I couldn't send it out and now it's Monday again (oof now Wednesday). Shockingly there is somewhat of a happy ending to this chaos.

↪️ Here's the rundown:

March 8: Silicon Valley Bank announced its $1.8 billion loss on its bond portfolio, along with plans to sell both common and preferred stock to raise $2.25 billion.

March 9: $SVB stock crashed at the market opening. Other major banks also saw their stock prices take a hit. Additionally, more SVB customers began withdrawing their money, for a total attempted withdrawals of $42 billion.

March 10: Trading halted fro $SVB and regulators step in to take over. SVB couldn't find a buyer (yikes).

March 12: Federal regulators announce emergency measures in response to the Silicon Valley Bank failure, allowing customers to recover all funds, including those that were uninsured.

March 17: Silicon Valley Bank files for bankruptcy.

As you probably just read, March 12th was an extremely pivotal day for everyone. The fed announced that all depositors (those banking with SVB) would have their funds returned even if they were uninsured. Obviously, this is NOT normal and was due to the systematic risk that the entire market would occur.

On the other hand, investors won't be as fortunate. Although FDIC and this new one-time exemption can protect depositors from losses, it can't do the same for shareholders and unsecured debt holders. That basically means that people and organizations who owned stock in SVB Financial Group might not get their money back. SVB will have to sell off all assets and whatever is left in the wash.

Scandals

Wherever there's smoke there is fire. With any financial collapse of epic proportions, there is always a scandal in the mix. Less than two weeks before Silicon Valley Bank went down the tubes the CEO Greg Becker solver over $3.6 MILLION dollars worth of company stock. hmmmm I wonder if that was a coincidence?

Other public outrage came from many users on Twitter saying that David Sacks and Jason Calacanis (both famous venture capitalists and tech entrepreneurs) added fuel to the fire and were a major factor in the bank run that led to SVBs demise. On twitter they posted tweet after tweet instilling fear into their millions of followers (many of which are startup founders that bank with SVB) that SVB was in deep trouble. Jason was tweeting in all caps all day long and even posting mad max gifs assuming this was the start of the apocalypse. You can see what this was all about below.

Crisis = Opportunity 💰

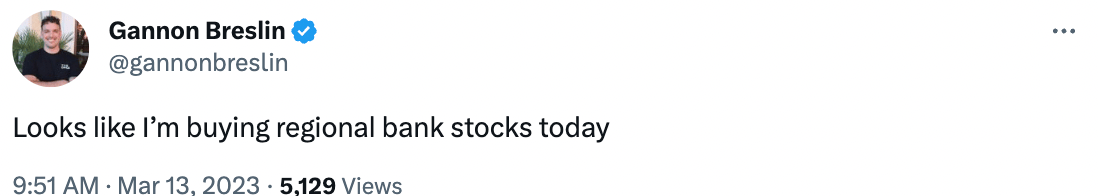

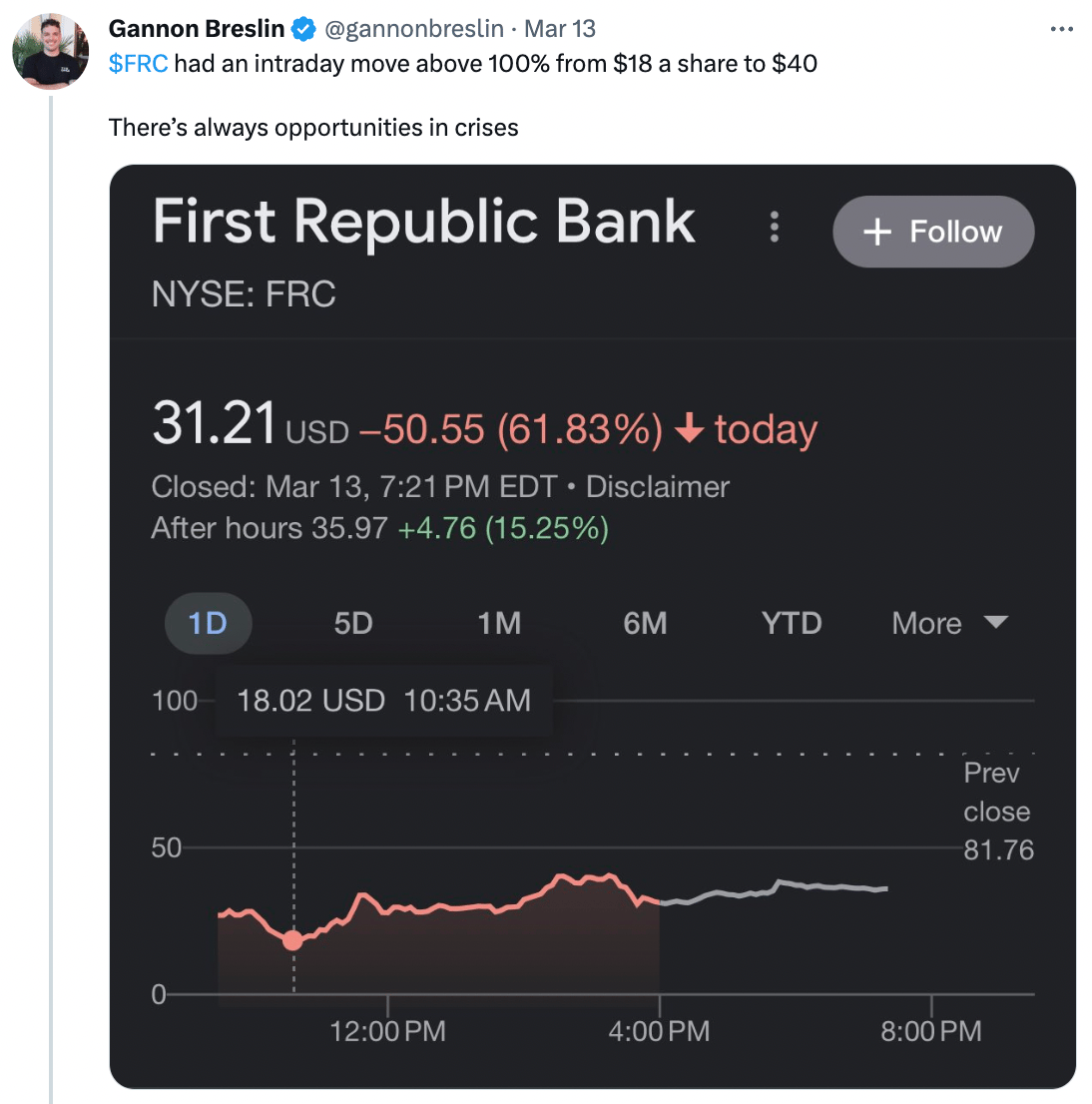

Once SVB plummeted in stock price so did many smaller banks as well. One that got hit especially hard was $FRC First Republic Bank which dove down to $18 a share. Obviously, I felt like this was an oversell especially when I felt like there was a good chance the Fed was going to step in and insure all depositors regardless of amounts. So I tweeted early in the morning below:

Now call it what you want, but after years and years of seeing stocks fly in exaggerated directions, I felt like this was a good asymmetric bet to make. Needless to say, $FRC drove back up to $40 a share inside one trading day. That's a 100% move right there.

Conclusion

Banks are greedy and your money is only truly safe between your drywall or in solid gold.

I hope you learned a thing or two about banking and bonds and thank you for reading this far. If this was helpful or enjoyable to read please send it to a friend to share! I will be coming out with more newsletters very soon once I cure this terrible bout of procrastination.

Have a great Wednesday and tell someone you love them!

Gannon

Meme Bank