TOGETHER WITH

Welcome to Rebel Markets Newsletter by Gannon Breslin. Join 5,500 others to learn more about investing, entrepreneurship, tech, media, & all things that involve money. Thank you to everyone who supports my content by checking out the sponsored links (you the real MVPs).

My other articles 🗞️ Twitter 😊 All links 🔗

Good morning fam,

You have exactly less than 4 more days to contribute to your 2023 ROTH or Traditional IRA - after April 15th this window is closed and you can only contribute to 2024. If you do not have an IRA of any kind this will be one of the most important articles you read to date. If I received a dollar for every time someone DM’d me on Twitter or in person asking me about what an IRA is I would have been able to contribute to 2024 by now. I will “try” to keep it brief but also make sure I cover all the “need to know” because these investment vehicles are extremely important and can be a major driving force for your retirement. If you don’t have an IRA already I highly recommend looking into them and this newsletter is a great start. Take control of your own retirement today because I can guarantee you nobody else will. Again, I am NOT a financial planner, CFP, professional retirement planner, etc. All information below is information I have gathered from articles, the IRS website on IRAs, and books I have read on the subject matter - as always do your own due diligence.

Grab a cup of coffee because this is going to be a long one but it can change your life so it’s worth the read. I apologize in advance for the novel but there just simply isn’t a short way to cover this topic.

To start, let’s go over some crucial terms that have to be understood before reading this newsletter.

Tax Deferred - This is income tax that is deferred or “put off” to a later time.

Deductible Contribution - The contribution made by the individual to the IRA is pretax and deductible on your tax returns.

Non Deductible Contribution - The contribution made by the individual to the IRA is made with after-tax dollars and therefore cannot be deducted from your taxes.

Contribution - Yearly amount of money you put into your IRA.

ROTH IRA & TRADITIONAL IRA 💰

There are many things that a Roth IRA and Traditional IRA do that are the same. To start, an IRA is an “Individual Retirement Account” in which the sole purpose of the account is to grow your earned income with tax advantages that you won’t find in a normal brokerage account. Remember, in a normal brokerage account you can be taxed heavily off of short-term capital gains: Realized gains that you incur by selling a stock by not holding over a year (which can be up to 37% depending on your filing status of married, single, etc. and tax bracket). Although much less, you will also be taxed on long-term capital gains: Selling a stock after holding it for more than a year.

💡 The reason why IRAs are so important: At 59.5 years old you can pull all of your money out of a ROTH IRA completely 100% TAX FREE (nowhere else you will find this tax advantage) and a Traditional IRA tax-deferred (way better than short/long term capital gains tax). Using these instruments can literally save you hundreds of thousands in taxes at retirement.

An IRA is a retirement vehicle that has specific tax advantages for individuals that you simply won’t find elsewhere.

For both Traditional and Roth, if you are younger than the age of 50 you can contribute up to $6,500 for the 2023 contribution year. If older, you can contribute up to $7,500 for the 2023 contribution year.

Both the Roth IRA and Traditional IRA are retirement accounts and all contributions can not be withdrawn before 59 1/2 years old without incurring some serious penalties. For a Roth, there are some exceptions but that will be lower in this newsletter.

Contributions made to both IRAs start on January 1st of each year and end on tax day of the following year (April 15th). For example, right now as stated before you can still contribute to your 2023 contribution until April 15th, 2024. If you haven’t done this DO IT! Once April 15th passes no contributions can be made for the 2023 slot again. Later in this email I will go over why it is so important to try to contribute to every year possible to the max.

Major Differences 🚨

One of the biggest differences between the Roth IRA and the Traditional IRA (also likely a main reason why a person might choose one over the other) is how much income in a single year you are allowed to make to still be able to contribute. To make it more interesting, this isn’t the normal gross income that is used in these limitations. What is used is called “MAGI” or “modified adjusted gross income”. In the IRS’ infinite wisdom, this calculation is NOT on your tax return so you or your CPA have the lovely fortune of calculating this yourself. Long story short, “MAGI” can be defined as your household’s “AGI” adjusted gross income with any tax-exempt interest income and certain deductions added back. For someone who isn’t doing anything too crazy, usually, the MAGI is very similar to your AGI number.

For a Traditional IRA, there are no income limitations - meaning that no matter how much money you make in the year you are allowed to contribute. With a Roth IRA you have boundaries on your earned income. If you make too much money in a given year you will not be able to contribute for that given year. Here are these limitations charted below.

Roth IRA Contribution Limits

(Tax Year 2023)

Now let’s go over some of the basic differences below…

The most important principles are fully bolded.

Roth IRA 📍

• You may NOT be able to contribute if your income exceeds the limits (displayed above)

• Contributions are made from income that is already taxed (I.E. contributing a part of your paycheck that is already taxed)

• All earnings and capital gains from investments can be TAX FREE upon withdrawal if after 59 1/2 years old (this is a HUGE deal)

• Contributions are NOT tax-deductible

• Contributions can be made after 70 1/2 years old if earning income

• If you are the original owner you do not have to start withdrawing money from your IRA at a certain age past retirement, you can leave all your assets in your ROTH in full to your beneficiaries/heirs

• Cannot be converted to a Traditional IRA

Traditional IRA 📍

• There are NO income boundaries for contribution. This means no matter what your income is you can contribute to a Traditional Ira

• All earnings and capital gains from investments are tax-deferred until withdraw

• All of these withdrawals from a Traditional IRA are included in your gross income, which is subject to federal income tax but since they are tax deferred you will likely be in a lower tax bracket than your prime earning years at retirement!

• Contributions are made from income that is pre-tax or post-tax…

• How can you invest pre-tax? You can invest pretax dollars in your Traditional IRA in the sense that money you contribute is tax deductible, but you have to wait to file your taxes, unlike pre tax contributions to an account like a 401(k)

• As said above, contributions can be tax deductible. For all the John McAfee’s out there, I’m sure a light bulb just came on. Let me pull the plug. Your deductions are capped based on… you guessed it, your MAGI. Otherwise, people would contribute whatever they possibly can to lower their taxable income as much as they can. How else would Uncle Sam take your hard-earned money if that was allowed?!

• This is where it gets a little tricky. If you are covered by an employer-sponsored retirement plan you may or may not be able to have your contribution be tax deductible based on your income. Again, this “deductibility” is based on your MAGI and you can find the details for this info here.

• Cannot contribute if older than 70 1/2 years old

• You must start taking distributions (withdrawing money from your IRA) by April 1st following the year in which you turn age 72 (70 1/2 if you reach the age of 70 ½ before January 1, 2023) and by December 31 of later years

• With a Traditional IRA, you can convert to a Roth IRA but not vice versa

Trade Like A Politician Using Autopilot ♟️

Look friends I think there’s a reason why Nancy Pelosi has a net worth of 120+ MILLION with a salary just shy above 200k … and I think it has something to do with her being an expert stock picker. Well now instead of sitting on the sidelines, you can join in on the fun.

Using Autopilot you can easily connect your brokerage account and automatically copy trade alongside famous politicians and fund managers such as Dr. Michael Burry, Ken Griffin, Warren Buffett, and others without lifting a finger.

Join over 600,000 others and download Autopilot today

How do I actually start an IRA? 💡

Many brokerages allow individuals to create a Roth IRA/Traditional IRAs on their platform. To just name a few are: E*Trade, Fidelity, Ally, Charles Schwab, Vanguard, and Robinhood. It’s pretty straightforward but you set up an account, fill out the form, and make sure you choose Traditional or Roth IRA vs. a normal brokerage “cash” / “margin” account. If you are confused, you can call a representative and they will happily walk you through it. I use Charles Schwab because that is where my personal investing (nonretirement) account is. I like to have both accounts under one roof so I can stay on top of it. Since I am a very active investor, I personally trade here and there in my Roth but that is only something I recommend for more seasoned investors. My investing style is different in each account because one is for retirement which keeps me more on the conservative long-term side.

How do I buy and what do I buy? 💡

IMPORTANT: Unlike a 401k, where you set percentages for your company/representing firm to allocate funds into mutual funds, you yourself need to buy the assets inside of your ROTH/Traditional IRA. Otherwise, your contributions will just sit there in your account as cash and not growing which defeats the entire purpose of starting an IRA.

Just like a personal brokerage account, you need to buy shares of stock, index ETFs, mutual funds, and other instruments in your IRA to have it start working for you. Many individuals treat their IRA as a “set and forget” investment strategy so I highly recommend looking into Vanguard Index ETFs.

ETFs or “Exchange Traded Funds” are essentially a large basket of stocks that represent a specific sector, market index, etc. that are grouped into one fund that you can buy shares of. By buying an ETF you are buying small pieces of many companies. Here is a list of Vanguard ETFs. Again, each ETF will have a “ticker” symbol. This is the symbol that you will type in on your brokerage. Vanguard has very well-known ETFs like $VOO (S&P 500 ETF), $VTI (total stock market), $VYM (high dividend yield), and $VGT (high growth tech) to only name a few. Individuals like Vanguard ETFs because of their low cost (expense ratios usually ranging between .04%-.07%), safety (vanguard has been around for decades), and reliability to track the underlying index.

Mutual funds can be an attractive choice looking for a leg up on the market and wanting to outperform the total market (S&P 500, Nasdaq, Dow, etc.). The trade-off is high maintenance fees which can be upwards of 2%! Think about it this way… if $VOO performs 8% in the year and XYZ mutual fund performs 8.75% who had a better year if 2% is then taken off the top? Needless to say, you can strike gold and have the next Peter Lynch of Fidelity Investments be your mutual fund manager and perform an average of 26% per year over a 13-year tenure. In that case yes, a 2% expense ratio is WELL worth it. But again, we are talking about one of the ALL-TIME GOATs in portfolio management. It is my personal opinion, that I see mutual funds only attractive when trying to diversify and invest in foreign and emerging markets - or you are close to retirement and need more conservative portfolios focused on bonds, treasuries, etc. As an American, living in America, it can be hard to get a real grasp of these foreign markets and a mutual fund that specializes in studying and analyzing these companies in these other regions can be of a great advantage.

DANGER ZONE 🚨

• Do not contribute over your contribution amount for your Roth IRA. The IRS will most likely find out and you will be hit with a nice fine at withdrawal. Tax laws impose a 6% excise tax per year on the excess amount for each year it remains in the IRA. If you already know you accidentally contributed too much bring it up with your CPA to withdraw the correct amount. Every year you wait the wound will get bigger and bigger.

• Do not contribute if you do not have earned income for that year. The IRS will most likely find out and you will be hit with a nice fine at withdrawal very similar to the story above. Capital gains, passive income from DPPs, alimony, child support, pension payments, and dividend income are NOT earned income.

• Do not withdraw funds before 59 1/2 in either Traditional or Roth IRA. The IRS will most definitely find out and you will be hit with a 10% penalty on top of getting the income tax treatment that you were trying to avoid in the first place.

IRA “Loopholes” 👀

• Money withdrawn for first-time purchase of a principal residence if you are a first-time homebuyer (up to $10,000). Oddly enough, the IRS defines “first time” as purchasing a residence within the past two years. For instance, if you purchased a principal resident 5 years ago you may be eligible for the $10,000 withdrawal. Again, to stay safe I would consult a CPA, CFP, or/and your IRA brokerage before doing this.

• Account holder has become disabled or passed.

• For principle residence withdraw if your IRA is a Roth Ira the account must be made at least 5 years following your first contribution.

• There is a thing called a “Backdoor Roth” which I am not going to cover here. Long story short, if you make too much money to contribute to your Roth IRA there are ways /accounting measures you can take. Google it if need be.

• If you are older than a certain age (50 for Roth) you can be eligible for “catch-up” contributions in which you can contribute more than your filed status.

Why you should start NOW! ⚡️

You have probably heard it before, but the real key to investing is the compounding effect. If I have a $10,000 dollars and I have a 10% return for the year then at the end of the year you gained $1,000 so now you have $11,000 in the account. If the next year I perform 10% again I will end with $12,100 in the account for that year and so forth. On top of this, dividends are incredibly crucial to a retirement account. If you have DRIP turned on (dividend reinvestment plan) for your stocks that means every time a company that you own pays out its dividends it will automatically buy more shares or a fraction of those shares in stock. Over time this can reap massive gains in your account. Again you are going to have your IRA for likely decades so compounding effect and DRIP is a big deal. Another thing that an IRA inherently makes an investor do is “time in the market” vs. “timing the market”. If you invest your contribution every year you are effectively following a DCA method. DCA stands for “Dollar Cost Averaging” in which you are investing a certain amount of money no matter what on a scheduled basis. Of course you could technically contribute to your IRA and have the money just sit in the account and not make any stock/ETF/mutual fund purchases but in my opinion that would defeat the whole purpose of starting an IRA in the first place. I make it a goal to invest my contribution by year’s end every year because I am a full believer in time in the market vs. timing the market especially when it comes to such a long time horizon such as saving for my retirement. Nick Maggiulli (@dollarsanddata on Twitter) writes an absolute masterpiece on DCA method vs. lump sum and very accurately shows how much better it is to not try timing the market when investing. If you are interested in that article you can find it here.

So what’s the rush? ⏳

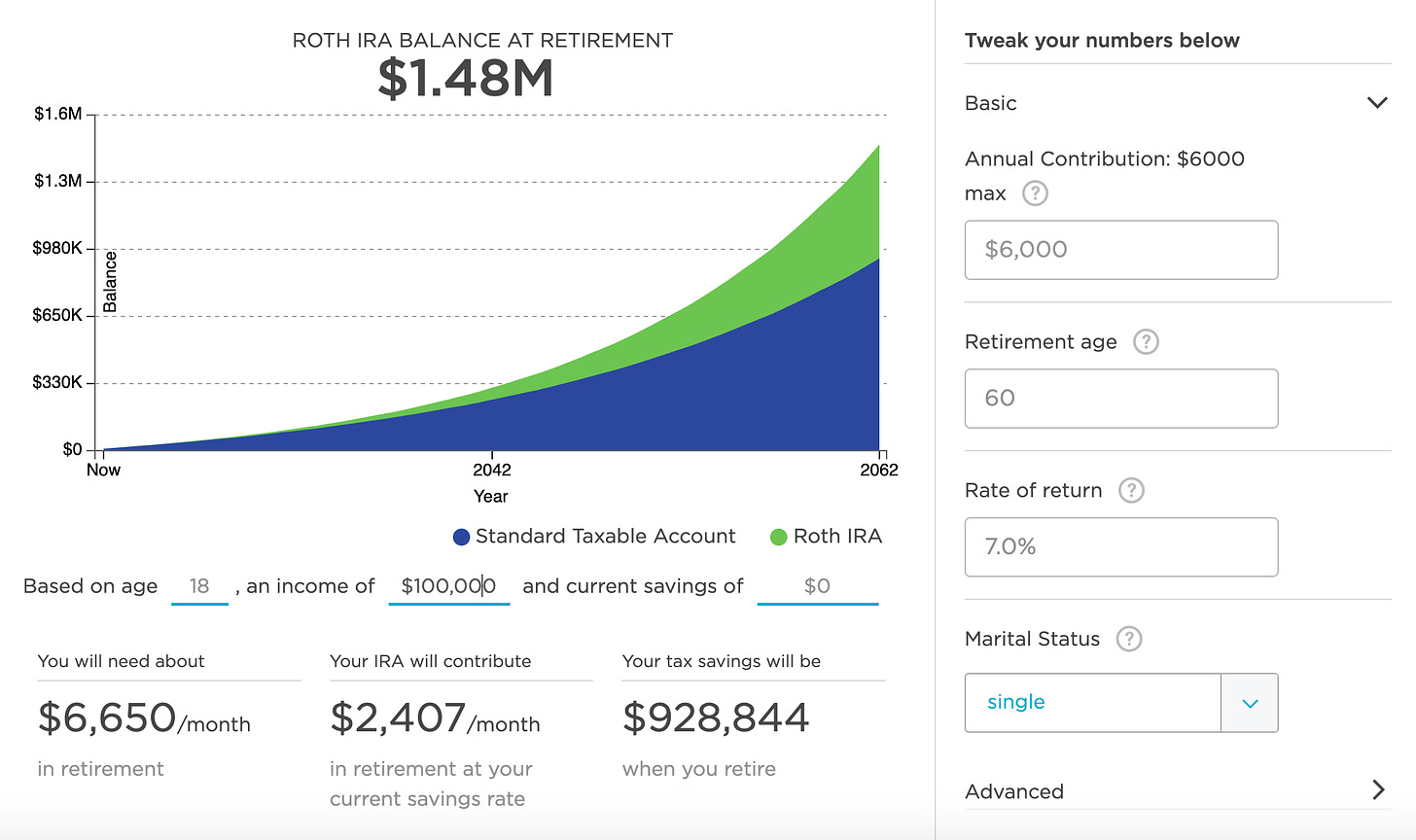

Let’s look at some data. If you got a job at 18 and started fully contributing to your Roth IRA every year on out (let’s assume your portfolio grew 7% every year) by the time you are 60 you are looking at around $1.48 MILLION dollars that you can withdraw with ZERO taxes on it. I used 7% because that is generally the figure that finance institutions use as the historical yearly average rate of return of the S&P 500 (including inflation). As you can also see you saved over $928,000 in taxes that you would have encountered in a personal non IRA account. Again with a Traditional IRA the taxes would not be zero but they will be deferred in the hope and assumption that come retirement you will be in a much lower tax bracket.

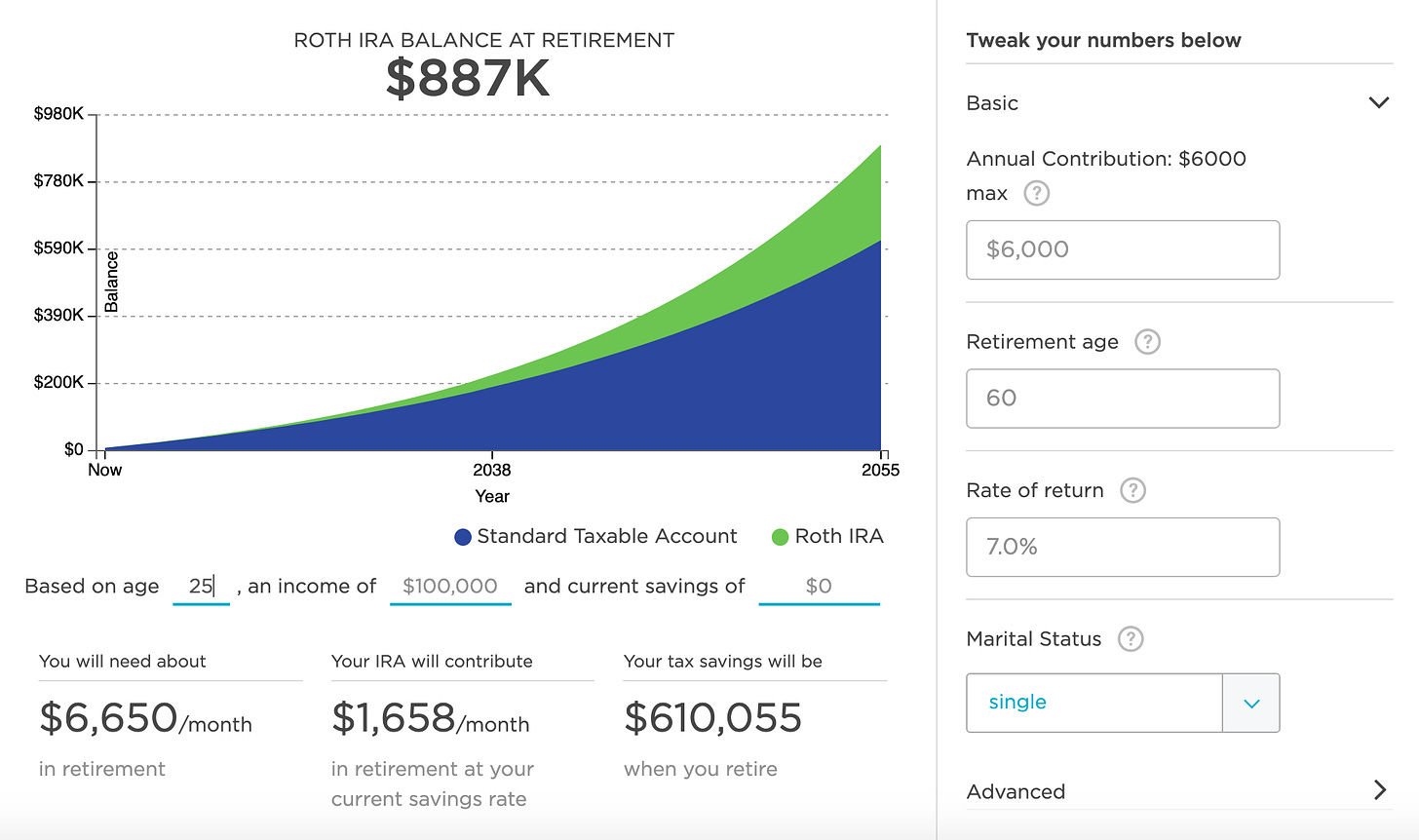

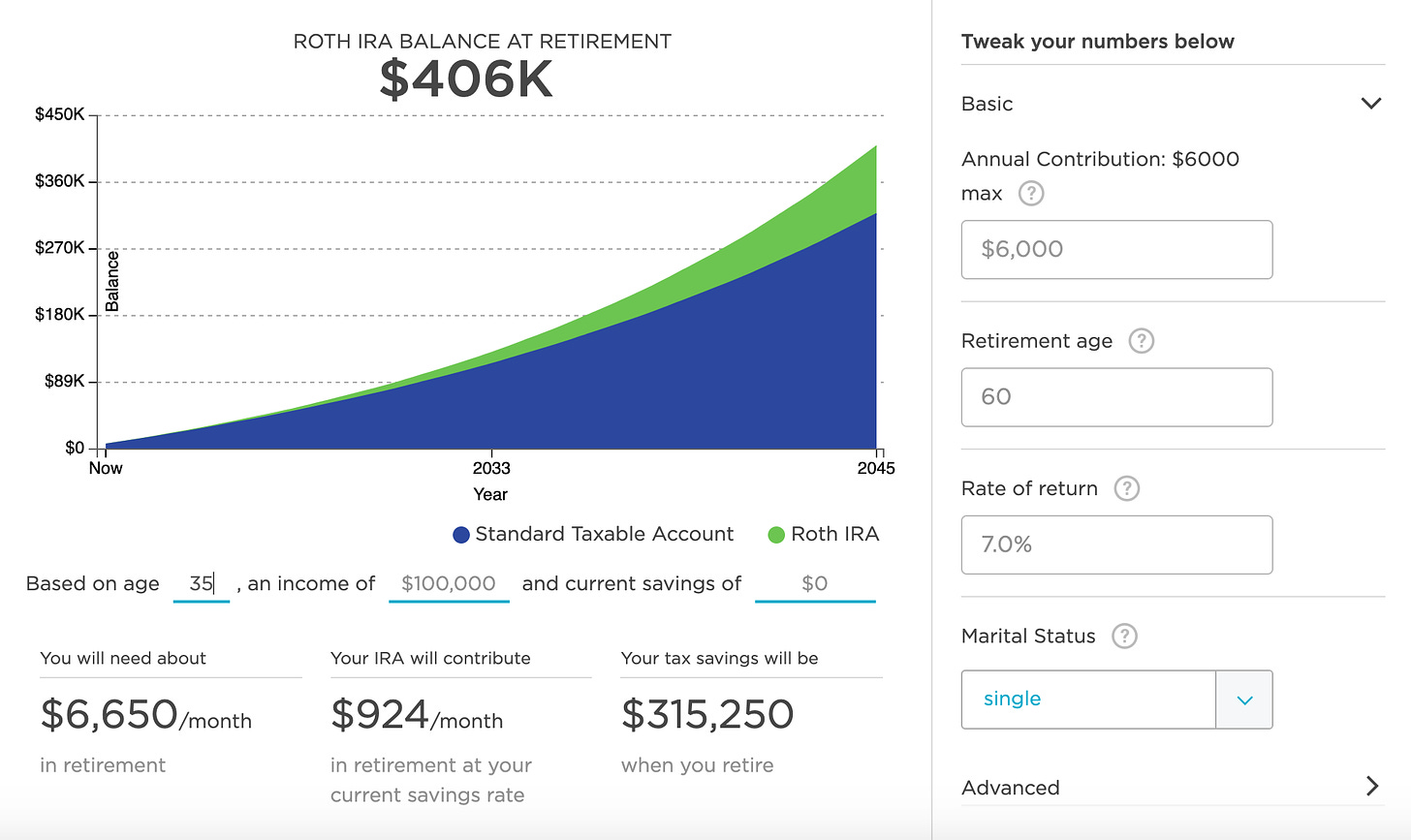

Now let’s compare that to starting your Roth to fully contribute at 25 and 35. As you will see below, that is a difference of $593k and $1.07 million assuming the same 7% rate of return.

What I am trying to convey is every year matters especially when you are younger. Each year you miss a contribution when you are young has an exponential compounding effect of missing future gains in your IRA. Again, all figures above are abstract, although the historical average rate of return of the S&P 500 is 7% that is not by any means a guarantee moving forward.

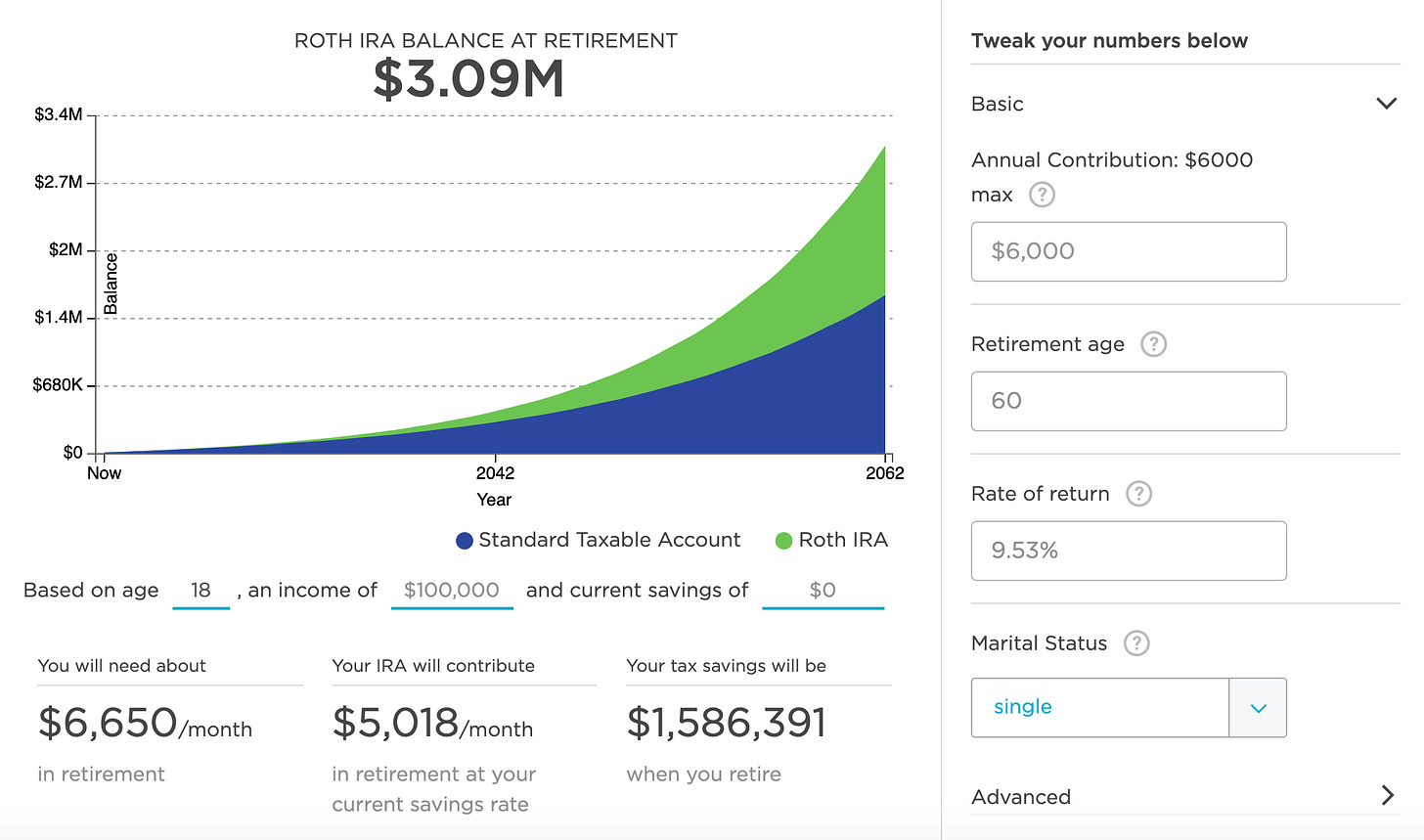

Last but not least ☝️

If you are like me you are seeking a greater performance than 7% in your IRA. I didn’t start contributing to my Roth IRA until I was 21, but luckily or skillfully I have managed to outperform the overall index considerably which makes up for the missed years. Just having a basic understanding of fundamental stock analysis can land you investing in a company that greatly outperforms the S&P 500, which can do numbers for your IRA. In a way, that is the ultimate goal of my newsletter and Twitter - not to get you to just start investing but to get you to outperform the S&P 500 by .01% every day. Why such a small amount? There are 253 trading days in a year and if you outperform by .01% a trading day you land at an outperformance of 2.53% per year. Ok, so who cares? Below you will see what an outperformance of 2.53% or an average rate of return of 9.53% can do for your Roth IRA.

Disclaimer: Again this is assuming you outperform the 7% historical average by 2.53% and you start contributing at 18. If starting at 25 you are looking at $1.6 M with the same performance. All numbers and figures displayed in this newsletter are fictional returns and not guaranteed.

So for everyone that got this far - TL, DR.

Start your IRA and figure out which one is best for you. Who knows if social security will still be around in decades to come.

This is your retirement and future, nobody is going to save your *ss so act accordingly.

Have a good start to the week,

Did this newsletter help pump your bags? If so and you would like to send a tip, my ETH address is gannonbreslin.eth 🖤 Thank you to all those that support and donate.

Before you go, If you know someone who has NOT set up a personal retirement vehicle for their future please share this article with them. It very well could be the best gift you ever give them 😊

Today’s Sponsor: Thank you to Autopilot for sponsoring today’s newsletter!

Did you enjoy this newsletter?

📈 Need help scaling your Newsletter or Twitter? 📈

Background: I have successfully scaled 3 email newsletters and multiple Twitter accounts to tens of thousands of followers and subscribers. Along with this, I have been able to leverage these accounts to mid 6 figures in gross profit. I also have experience in advising several fintech apps on product development, user acquisition, and social strategy that have successfully gone to market. Notably Commonstock (acquired by Yahoo Finance) and Follow (Atomic VC backed).

TL; DR: My expertise is in all things that deal with newsletters, ad sales, social media monetization, Twitter growth, and more.

Can help advise on:

Newsletter monetization

Newsletter design

Newsletter funnels

Newsletter tools/hacks

Running a newsletter team

Twitter growth and strategy

Your product or brand (strategy, design, user acquisition)

If you are interested in being helped with anything mentioned above send me an email at [email protected]

Spots are filling up FAST!

Disclaimer: Rebel Markets Newsletter does NOT provide financial advice. All content is for informational purposes only. Rebel Markets is not a registered investment, legal, or tax advisor or a broker/dealer. Trading any asset is extremely risky and could result in significant capital losses.